Business Insurance

In business, sometimes things don't go to plan. Sometimes the unexpected happens. The question is: what happens next?

In business, sometimes things don't go to plan. Sometimes the unexpected happens. The question is: what happens next?

Insurance Advisor

With more than 20 years experience as a Financial Advisor focused on risk assessment, Tim ensures his clients have appropriate plans in place to protect their business, families and future.

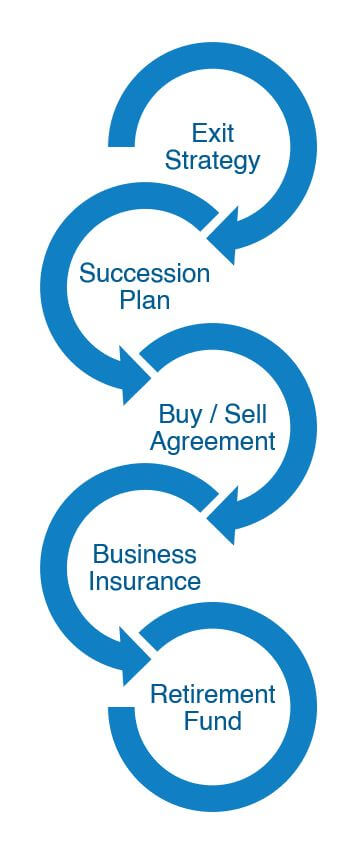

As a business owner, it is crucial that you have a plan in place for both intended and unintended exits. Having a Succession Plan or Exit

Strategy is one vital component, and the second is having the right insurance in place to protect what you have worked so hard for.

Whether you are in business by yourself, or with a business partner, consider:

There are a range of solutions we can help you with to ensure you and your business is protected.

Do you understand all the fine print in any of your personal insurance policies and know exactly what you’re covered for? If not, that’s where we can help.

You might think:

"I’m cluey enough to understand what my car insurance covers. What’s so different about personal insurance (life insurance, income

protection, TPD, critical illness)?"

It’s about understanding the implications of each policy, so you know exactly what you’re covered for and can make informed choices. It’s our job, as an insurance specialist, to understand the nitty gritty of different policies and all the associated options. Personal insurances are more complicated than car and home insurance. And it’s not just about knowing what the words mean. We can help you interpret the detail so there’s no surprises when it really matters.