Collaboration, Communication and Understanding

Our trusted advisors build a collaborative, ongoing relationship with each client in order to truly understand their unique needs and goals. This tailored approach means our clients benefit from the most effective financial and business solutions for both now and the future.

Experience, Expertise and Knowledge

Our advisors and their teams offer a wealth of knowledge and business experience, and we are constantly looking for opportunities to add value and achieve the best outcomes for our clients through our full suite of integrated professional services.

Delivering the best customised, expert and compliant advice for your business.

All aspects of taxation; from complex corporate tax to basic returns for individuals and SMEs.

Plan, build, protect and manage your personal wealth and investments.

Self Managed Super Fund experts to help you take control over your future retirement fund.

Strategic advice, solutions and valuable insights to deliver positive change for your business.

Expert analysis of your organisation’s processes, procedures, compliance and areas of risk.

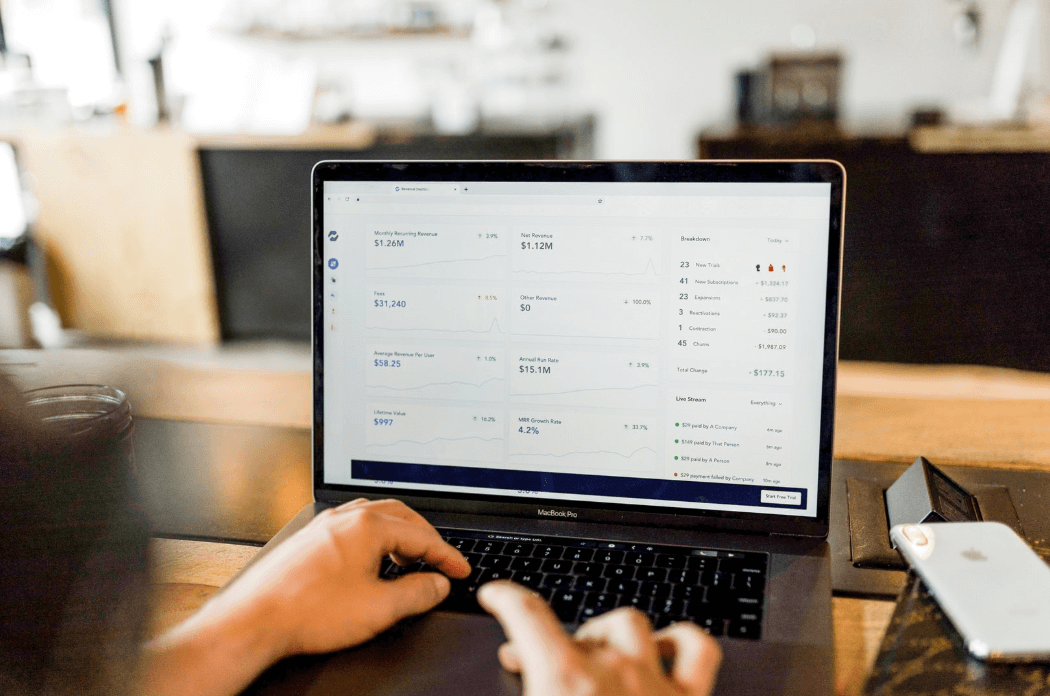

Custom, cloud-based software solutions that integrate and automate all your business' accounting and tech functions.

Our highly experienced bookkeepers assist with business processes, get you up to date and keep you on track.

Complete lending solutions to simplify financing all your commercial, SMSF, business and personal loan needs.

As a proud member of AGN International – an association of independent accounting and advisory firms – Ashfords benefits from an intelligent, diverse network of nearly 200 member firms spanning 80 countries. Such access ensures Ashfords’ clientele are privy to valuable, cutting-edge insights on industry issues far in advance of their competitors.

What’s this new tax:

On 20 March 2024, the Victorian State Government introduced the Commercial

and Industrial Property Tax Reform Bill 2024 (legislation.vic.gov.au).

The Bill is expected to become law and to take effect from 1 July 2024.

The Victorian Government, as announced in the 2023-24 Budget, is progressively abolishing stamp duty on commercial and industrial

property and replacing it with an annual tax.

The annual tax, to be known as the Commercial and Industrial Property Tax (CIPT), will be set at 1% of the

property’s unimproved land value.

The tax will replace land transfer duty (stamp duty) that is currently payable on the improved value of the land when you purchase or

acquire a commercial or industrial property in Victoria.

The new tax system will start to apply to commercial and industrial property if the property is transacted on or after 1 July 2024.

.png)

Last week, Ashfords hosted the latest Building Business Value seminar. Maximising Business Value: Break Through the Barriers brought together a diverse panel of experts, featuring specialists from talent, marketing and finance to help businesses identify and overcome common barriers to enhance their business value.

.png)

A conversation at a community event kicked off productive philanthropic relationship between Ashfords and Down’s Community Farm. Twelve months on, we reflect on some of the key outcomes, including a successful grant submission that secured $200,000 in funding.

On 23 May 2023, the Victorian Treasurer, Mr Tim Pallas, unveiled the State's Budget, which includes a levy of additional payroll tax on large businesses and reforms to abolish lump-sum stamp duty for commercial and industrial properties.

The Federal Treasurer, Dr Jim Chalmers, handed down his second Federal Budget on 9 May 2023 which contained the first surplus in 15 years.

A new phase of Single Touch Payroll (STP) is being implemented in businesses across Australia.

In STP Phase 2 we see more information being requested from the Australian Tax Office (ATO).

Ashfords recent International Recruitment Seminar went off with a bang!

What can be done to protect ourselves, and our data, from threat?

An updated 2022/23 Federal Budget was handed down by Treasurer Jim Chalmers on the 25th October 2022. As the first budget from the new Labour Government, it outlines how it plans to deal with the current economic climate.

Struggling to recruit workers for your business?

Job vacancies have jumped 40% in 12 months, and ABS data shows

there are currently 470,000 unfilled jobs in Australia.

Ashfords brings together experienced professionals to discuss how to recruit workers from overseas, including the legal, compliance

and accounting considerations for businesses.

Australia. Employers are currently facing a chronic shortage of staff across multiple industries and the

impact is being felt by businesses large and small.

Ashfords is thrilled to announce the continuation of the Major Sponsorship with the South East Melbourne Phoenix for the upcoming NBL23 Season.

Welcome to Finance Matters with George Shaheen

Read Finance Matters and be informed on what's happening in the market and the current business environment.

For George's second blog post, he talks about interest rates & CPI, business challenges and talks about a recession.

FuseSign is a new and easy to use electronic signing platform that is secure and streamlined for our clients’ upmost

convenience.

ATO SmartDocs enables us to download all ATO mail on behalf of our clients and distribute it efficiently.

We have recently heard about 'stagflation' in the media. But what does it mean? And how can it affect your financial position?

Welcome to Finance Matters with George Shaheen

Read Finance Matters and be informed on what's happening in the market and the current business environment.

For George's first blog, he talks about the cost of living, interest rates, and how to be prepared for the future.

The 2022-23 Victorian State Budget was handed down by the Victorian Treasurer on 3 May 2022 with the Government forecasting a net operating

deficit of $17.6 billion this financial year.

The budget mainly focused on health, education and infrastructure projects within Victoria and introduced no key changes to Victoria’s

current taxes and duties.

Treasurer Josh Frydenberg delivered the 2022-23 Federal Budget on the 29th of March, 2022. The Australian Government has delivered a budget that provides some good news in an election year when businesses are weathering another period of economic uncertainty.

Over the past 10 years the world of accounting has changed with the introduction of cloud-based accounting systems.

Xero and MYOB are probably the largest players in the market for small to medium businesses today.

The ATO are corresponding with employers to ensure that they are STP Phase 2 ready. Ashfords have compiled the following key information to address your questions about the STP Phase 2 program.

From 1 November 2021, directors can apply for the new director identification number (Director ID) introduced by ASIC. ASIC introduced the requirement for all directors to hold a director identification number to verify their identity as part of these new requirements...

2021 has been another challenging year, driven by unpredictable lockdowns and ever-changing restrictions forcing the need to adapt. It is clear the Covid-19 Pandemic has been one of the biggest hurdles I have had to face in the last decade

At Ashfords, we recognise that not all businesses are the same. This is why we offer different levels of bookkeeping, so we can work with you to choose the right services to deliver the best outcomes for your business. Find out more about our revamped bookkeeping service...

If you are a business owner, with business partners, have you ever thought about what could happen to your business ownership share if something happen to you?

AGN International Business Voice interviewed our very own Tom Willemsen on the investment opportunities of cryptocurrencies. Read the article "Making sense of cryptocurrencies" by clicking this link.

Ashfords' specialist guide to understanding superannuation guarantee charge and avoiding part 7 penalties.

Ashfords superannuation experts outline 6 new policy changes that are crucial to be aware of.

Ashfords Audit and Assurance detail regulations for the preparation of General Purpose Financial Statements for certain For-Profit-Entities.

We have all read about Daniel Andrews falling down the stairs and having broken ribs and fractured vertebrae and it looks like he will be out of action for a considerable period. It really highlights that accidents can happen at any time to anyone no matter who they are or what they do.

.png)

Ashfords' CEO, Greg Cusack shares some of our key learnings from the year that was, as well as insights as to what 2021 has in store for Ashfords and our clients as we continue to forge ahead in 2021.

The year is 2021, the global pandemic has forced businesses to respond to issues lying dormant in their systems and accelerated the need to future proof the way in which they use technology. Our resident experts at Ashfords Digital know firsthand the importance of using up to date integrated software to make managing your business easier. Basically, they’re here to help our clients work smarter and not harder.

The 2020-21 State Budget has been announced by the Victorian Government with many enticing proposals. Instead of a lengthy look at all the changes that were made, we’ve compiled some of the more important key points.

Ashfords is proud to announce a new major partnership with South East Melbourne Phoenix (SEMP) as the club heads into their second season in the NBL.

.png)

Reflecting on 2020, what have we learnt? How can we use it to fuel a smart race, not a hard one for 2021? These are some of the questions we all need to ask ourselves to start focusing on the future.

Following the recent release, we’ve compiled some of the more important key points to come out of the 2020/21 Federal Budget.

As the government begins to phase out the JobKeeper subsidy, we will keep you apprised of all the latest changes.

The Victorian Government has made available a number of new grants and supports for businesses as we move towards COVID Normal.

In a highly anticipated announcement, the Federal Government has announced the changes to its JobKeeper program.

New $5000 business support grant available for Victorian business that meet the criteria

These are challenging times for all, the new normal never seems to be defined, as we all work towards trying to protect the health and wellbeing of our colleagues and family members. A COVIDSafe plan is a key essential for any business, while it may constantly evolve, there are three areas as a minimum that it needs to address.

The 2020 financial year is almost done. What a rollercoaster of a year it has been.

So, it’s that time again and you have an audit coming up…? We’ve spoken with our audit team to get some insight into how to make the process run smoothly and to turn audit time into your favourite time of year!

You are invited to participate in our Forging Ahead program, designed to support your business right now.

An important update for businesses who have enrolled for JobKeeper or are planning to enrol.

The ATO has released details of the 3 steps to be completed to successfully receive the JobKeeper payment.

The JobKeeper payment is now open to eligible employers, sole traders and other entities to enable them to pay their eligible employee’s wages of at least $1,500 (before tax) per fortnight.

The JobKeeper scheme was introduced to support businesses struggling due to the impact of the COVID-19 pandemic. Based on the information available, we have put together a guide to show employers how they can apply for the JobKeeper payment, what the obligations are and what to expect.

The consequences of COVID-19 need to be considered by all entities in preparing financial reports that are subject to audit. What disclosures are required, are the impacts material to the business and do financial reports need to be adjusted?

On the weekend Scott Morrison announced the federal government's second round stimulus package, and Daniel Andrews announced the state government's plans for a stimulus package.

The future is digital and small business owners need to invest in Digital Marketing to keep up with the pressures of an increasingly wired world. In this article, Cuby Martis, Ashford's Digital Marketing Specialist, details the key benefits of adopting a digital strategy for your business.

Business valuations can be conducted in many different scenarios, but one scenario often overlooked is during a divorce. It is irrelevant whether both parties have an interest, or just one party; a business valuation of that interest is typically required.

Just like that, the decade is over, and a new decade has begun! A new year can often bring about a plethora of ideas that business owners want to implement, but a few things must be addressed before jumping straight into these new ideas.

Ashfords is the premier full-service business advisory firm servicing Dandenong and surrounding suburbs.

Discuss how we can provide peace of mind for you and your business with our tailored financial solutions.

Most businesses have a Christmas party to finish their working year, but what some businesses don't realise is that they may be hit with a tax for throwing such a party. This is known as Fringe Benefits Tax (FTB).

.jpg)

Cloud computing is the way of the future and its advantages are multi-layered.

The weakening of the Australian dollar (AUD) has been a topic of conversation for many in recent months. These talks have amplified over the past fortnight following the AUD’s tumble to its lowest value—relative to the U.S. dollar (USD)—in more than a decade.

Five of Ashfords’ team members recently attended Xerocon Brisbane 2019 (September 4–5), where they met and interacted with professionals from both Xero and their extensive network of partners. In so doing, they gained valuable insight on what Xero is working on and how different businesses are using Xero’s cloud-based accounting software. Below is a recount of Xerocon from one of Ashfords’ five attendees, Grace Tsuchida

Article explaining online identity fraud and how clients can protect themselves against it.

Australia has an ageing population; the media keeps reminding us, as does the government. Are we ready to deal with the implications of this, though? As a society? As individuals? One thing’s for sure—it’s something we cannot ignore.

Cash is still King when it comes to keeping your business' doors open, yet it is still one of the most neglected aspects of business. We've got an easy solution for you!

AASB 9 is applicable to a number of business, find out if you could be impacted

Reporting periods commencing on or after 1st January 2018 (From 1st January 2019 for Not-For-Profit entities) AASB 15 is applicable to the following businesses: Entities subject to an audit or review.

Starting 1 July 2019, changes have been implemented to the way employers report tax and superannuation payments to the Australian Taxation Office (ATO). This reporting change is called Single Touch Payroll (STP).

The Coalition Government has been re-elected in the 2019 Federal Election, with a small majority of seats in the House of Representatives, after taking a policy of stability for superannuation to the election.

There are significant changes coming to Accounting Standards. Ryan Dummett will discuss the changes and the impact of AASB 16 Leases.

With the 2019 Australian federal election just days away, we at Ashford’s thought it’d be worthwhile putting together a blog post outlining how each major political party is addressing the various hot-button issues from a policy standpoint. Taxation Widely seen as one of the most crucial dividing lines between the two main parties.

From 1st July 2019, Single Touch Payroll (STP) will apply to all employers regardless of the number of employees they have on payroll. STP was previously introduced by the ATO from 1st July 2018 for businesses with 20 or more employees, however new recent legislation has now extended the requirement to apply to all employers.

Superannuation Manager The federal election has been called for May 18 and both major parties have outlined their superannuation and tax policies. With the federal election only weeks away, many of our clients have been asking what the major political parties’ policies are, that may impact their SMSF, individual taxation circumstances

In this real-time world we find ourselves in, it’s often hard to ensure you’ve enough time to discharge your professional responsibilities – let alone to enjoy enough family, personal, and leisure time. It’s not the answer to be in a permanent state of Nivens McTwisp (i.e. the white rabbit in Tim Burton’s Alice in Wonderland).

We are aware that FBT is one of the less appreciated taxes, with little more than nuisance value for many of our clients – but legislation is something that must be complied with. As always, we endeavour to making this process as smooth as possible for our clients.